Start a freelance activity in Japan

Starting a freelance business in Japan is more than simple: you only need yourself and a one page paperwork!

Find here a quick resume of the steps you need to follow:

What is to be a freelancer in Japan? #

In Japan, a “Freelancer” is officially named sole proprietor1 and need to be registered at the tax office2. Being an owner of a company like a Company Limited3 or a Limited Liability Company4 is not considered as a freelancer activity in Japan. As a company owner, you must receive a salary from your company (and the company will pay half of the social insurances, and withdraw everything which needs to be withdrawn from this salary). As a freelancer, you are your business, so your incomes are the benefits from your activity.

Being a freelancer is also a different activity with being a full-time employee or a part-time employee. You are not a part of a company, but external to companies, which means you don't have the same benefits than the employees (health insurance, pension, employment insurance...).

Regarding your activity as a freelancer, you cannot do everything you want. The first restriction is that you are limited to one activity only, so it is very important to choose the contents and the name of your activity. For example, if you want to run a restaurant, you can have only one restaurant. If you declare you are a language teacher, you cannot work as a sales consultant for example. The second restriction is that you are limited to the activity included in your visa (have a look here for more details).

However, you can run a freelance activity and being a company owner or a full-time/part-time employee in the same time (if your visa allows it).

Fill in the documents #

The Notification for starting or ending a personal business #

Once you decide to start a freelance activity, the best thing is to inform the tax office you are attached to about your business. It is better to submit this document within 3 months after the official starting date of your business. First, print the document notification for starting or ending a personal business 5 and fill it out with the requested information. The National Tax Agency (NTA) also shares a document explaining how to fill it out (here), but only in Japanese. If you cannot understand it, feel free to use our sample below.

If you cannot print it, don’t worry. You just need to go to the tax office and to ask for this document. The staff might ask you your aim (Are you launching a business, ending a business, or do you want to make a change of your previous notification...), to be sure they are giving you the proper document. You do not need to go back to your home to fill it out, you can do it at the tax office directly if you have all the information required. Once the document is filled out, submit it to the staff and do not forget to get the precious copy of your registration stamped by the tax office. Then… it’s done ! You are officially a freelancer to the NTA and free to enjoy your business.

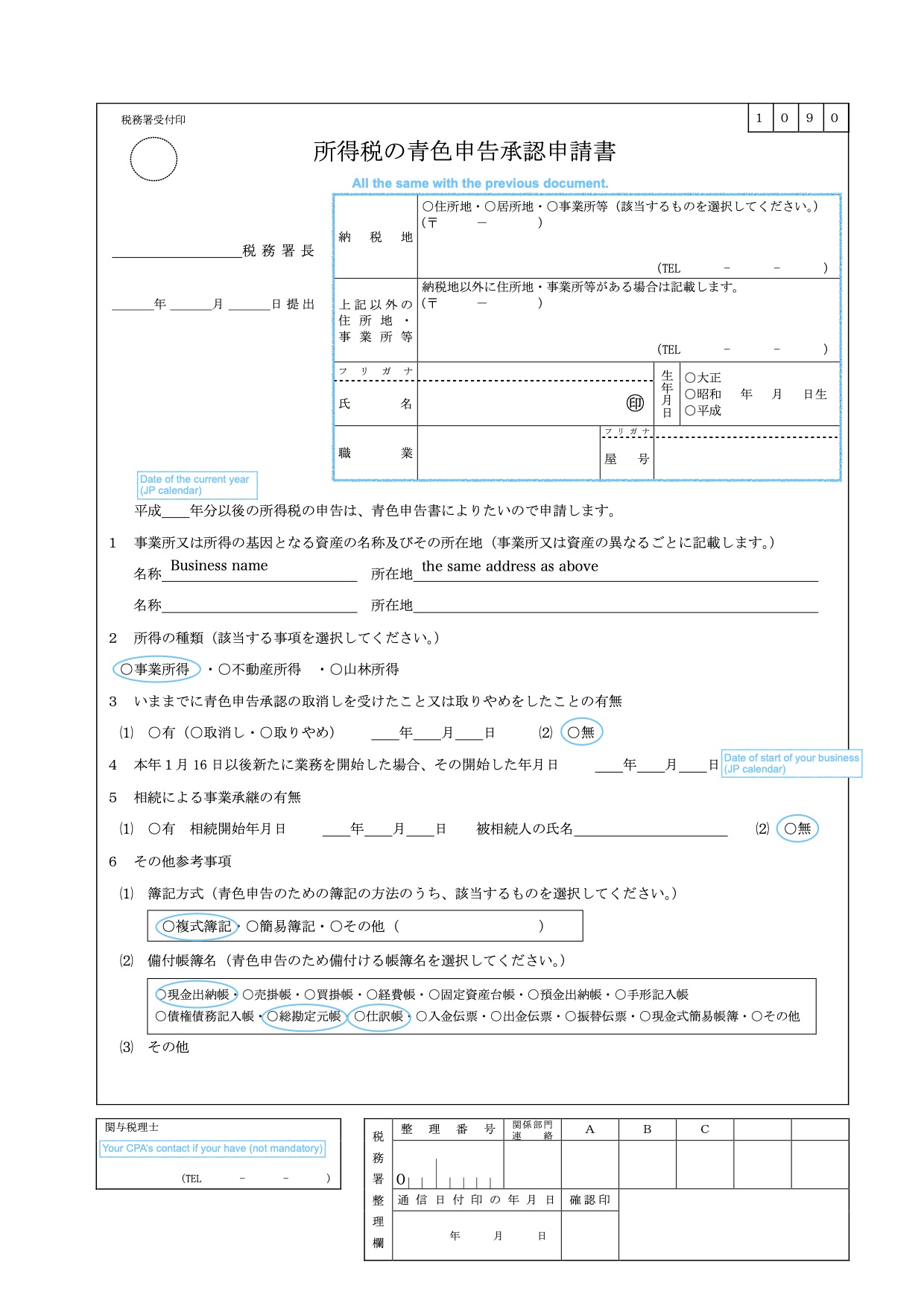

The Blue tax return approval application #

Furthermore, as you are already doing some paperwork, we should be aware that filling out another notification might allow you to get some tax advantages. We highly recommend you to also fill out the document Blue tax return approval application 6 and to submit it in the same time as the notification for starting a personal business. This document also includes the NTA’s explanations about how to fill it out, but only in Japanese, so feel free to use our sample below if you cannot understand Japanese.

This blue tax return is not mandatory, but will allow you to get a special deduction on your benefit of 100,000 yens or of 650,000 yens. It can help to decrease a little taxes, so do not mind the little extra paperwork and fill it out! For more information about the blue tax return, please refer to this blog (coming soon)!

Submit the documents to the tax office #

You need to submit the documents above to the tax office you are attached to. But the question is "how to know which tax office I am attached to?"

Do not worry, and use the search bar of the NTA website to find it. On the right side of the screen, you can see a search bar called "税務署を検索" (search a tax office). You can input your postal code or the beginning of your address, click on "検索" (search), and you will see the tax office you should go for all your tax procedures. The informations such as the tax office address and access, the opening hours and the phone numbers are on the website.

This might help #

1 Sole proprietor : 個人事業 kojinjigyō

2 Tax office : 税務署 zeimusho

3 Company Limited : 株式会社 kabushikigaisha

4 Limited Liability Company : 合同会社 gōdōkaisha

5 Notification for starting or ending a personal business : 個人事業の開業・廃業届出書 kojinjigyō no kaigyō todokedesho

6 Blue tax return approval application : 所得税の青色申告承認申請書 shotokuzei no aoiroshinkoku shōnin shinseisho